Earlier this summer Millrock CEO Greg Beischer showed off the potential of the 64North gold project adjacent to the Pogo Mine in Alaska.

The short video, shot by Spotlight Mining, clearly illustrates the strong drill targets.

Millrock generated this project to which Resolution Minerals (ASX:RML) is now earning an interest under an option agreement.

Drill results from the summer program are expected in October.

Millrock has a large shareholding in Resolution Minerals and presently owns a 58% stake in the 64North gold project.

It's a great video, and I highly recommend watching it.

To watch, click through the image below.

PROJECT CLOSE-UP: A Deeper Look At The Fairbanks Mining District

Recently, Millrock CEO Greg Beischer toured the Fairbanks Mining District, Alaska, with the Spotlight Mining video crew.

They put together a video, and it is a great introduction to the gold potential in Fairbanks.

There is a steady flow of news meant to come out over the next two months as assay results roll in.

Millrock vended its Fairbanks projects into a new company named Felix Gold (named after the prospector that first discovered gold in Fairbanks) (ASX: FXG) in exchange for a significant shareholding in Felix Gold and royalty interests in the area.

CEO PRESENTATION: Greg Beischer at the Denver Gold Group Forum

Last week, Millrock President & CEO Greg Beischer made a presentation to an audience at the Gold Forum in Colorado.

The presentation gives a great overview of our company's status and the potential catalysts that can drive Millrock’s share price upwards.

It is definitely worth a watch and you can do so through the image below.

CEO INTERVIEW: Gregory Beischer Discusses Alaska with Spotlight Mining

Last month, Spotlight Mining dropped into Alaska to visit Millrock and learn more about the project generator model, Millrock's projects, and what it's like building a land package in one of the world's most prospective gold belts.

During their visit, CEO Gregory Beischer dove into many aspects of Millrock and I'd like to share the interview with you today.

Some key highlights include:

0:40 - Greg gives a detailed breakdown of what Millrock is, what Millrock targets, and why Millrock follows the project generator model.

2:41 - Greg provides insight into why Millrock believes Alaska holds so much potential as an exploration area and why Millrock is well positioned in the state.

5:31 - Greg shares about the potential of the Fairbanks District and why Millrock sees tremendous opportunity there.

8:40 - Finally, Greg shares more on what investors can expect from Millrock over the next 4-6 months.

To listen to the interview below...

CEO Greg Beischer Presents at the Explorer and Developer Forum

Millrock Featured In The Alaska Miner: Summer 2021 Edition

Recently, The Alaska Miner published their quarterly Summer 2021 edition, in which Millrock Resources was featured in.

You can check out the full magazine and Millrock’s feature on page 30 here or you can download just the feature here.

With field season underway in Alaska, the magazine is also filled with tons of great info, so please take a read of this complimentary copy we have for our investors.

Millrock Recognized at NOIC 2019

At this years, 2019 New Orleans Investment Conference, Millrock was recognized for participating in the conference for 10 or more consecutive years.

As a company, we are committed to continuing to tell the Millrock story and have been on quite the journey since our inception.

We are honoured to be in such good company each year at the conference.

Greg Beischer accepting the award from Brien Lundin.

The Economic Benefits of Mining In Alaska

As seen on AlaskaMiners.org

Mining is a growing force in Alaska’s economy.

Mining is a growing force in Alaska’s economy, providing jobs for thousands of Alaskans and millions of dollars of personal income throughout Alaska. Alaska’s mining industry includes exploration, mine development, and mineral production. Alaska’s mines produce coal, gold, lead, silver, zinc, as well as construction materials, such as sand, gravel, and rock.

In 2018, Alaska’s mining industry provided:

4,500 direct mining jobs in Alaska.

9,200 total direct and indirect jobs attributed to the Alaska mining industry.

$715 million in total direct and indirect payroll.

$358 million in payments to Alaska Native corporations.

$149 million in state government-related revenues through rents, royalties, fees, and taxes.

Mostly year-round jobs for residents of more than 60 communities throughout Alaska, half of which are found in rural Alaska where few other jobs are available.

Some of Alaska’s highest paying jobs with an estimated average annual wage of $102,100 — over twice the state average for all sectors of the economy.

$34 million in local government revenue through property taxes and payments in lieu of taxes.

Each year AMA commissions the McDowell Group to research the economic impact of Mining in Alaska. Continued investments by the mining industry ensure Alaska’s continued economic growth.

Click here to read the current (2018) Economic Impact Report for Mining in Alaska

Faces of Mining Feature: Traci Hartz

Our colleague, Traci Hartz, was recently featured in the Faces of Mining section of the Alaska Miner Magazine.

Traci is Millrock’s Land Manager and Office Manager up here in Anchorage and makes certain all our mineral rights are maintained are in good order – a critical responsibility for an exploration company. She also has a myriad of other administrative responsibilities necessary for smooth operations here at Millrock.

We are proud she is part of Alaska’s modern mining industry and grateful to have her as part of our team.

Click to zoom in and read the feature!

Everything You Need to Know about Lithium

The following infographic breaks down everything you need to about the metal.The future goes through lithium.

The Future of Gold Exploration is Under Cover

Over billions of years, extraordinary amounts of gold and other metals were deposited and spread throughout the Earth’s crust. Humans have been searching for these rich deposits for centuries, and advances in geoscience and technology have helped us become more adept at finding them over time.

However, even with today’s advancements – almost all early-stage prospecting methods are still based on the same key principle: trying to find areas of exposed bedrock, called outcrops, that indicate an orebody is near.

But such outcrops only form in certain circumstances – and what happens when a geological system doesn’t come in contact directly with the surface?

Millrock Begins Second Round of Drilling at La Navidad Gold Project

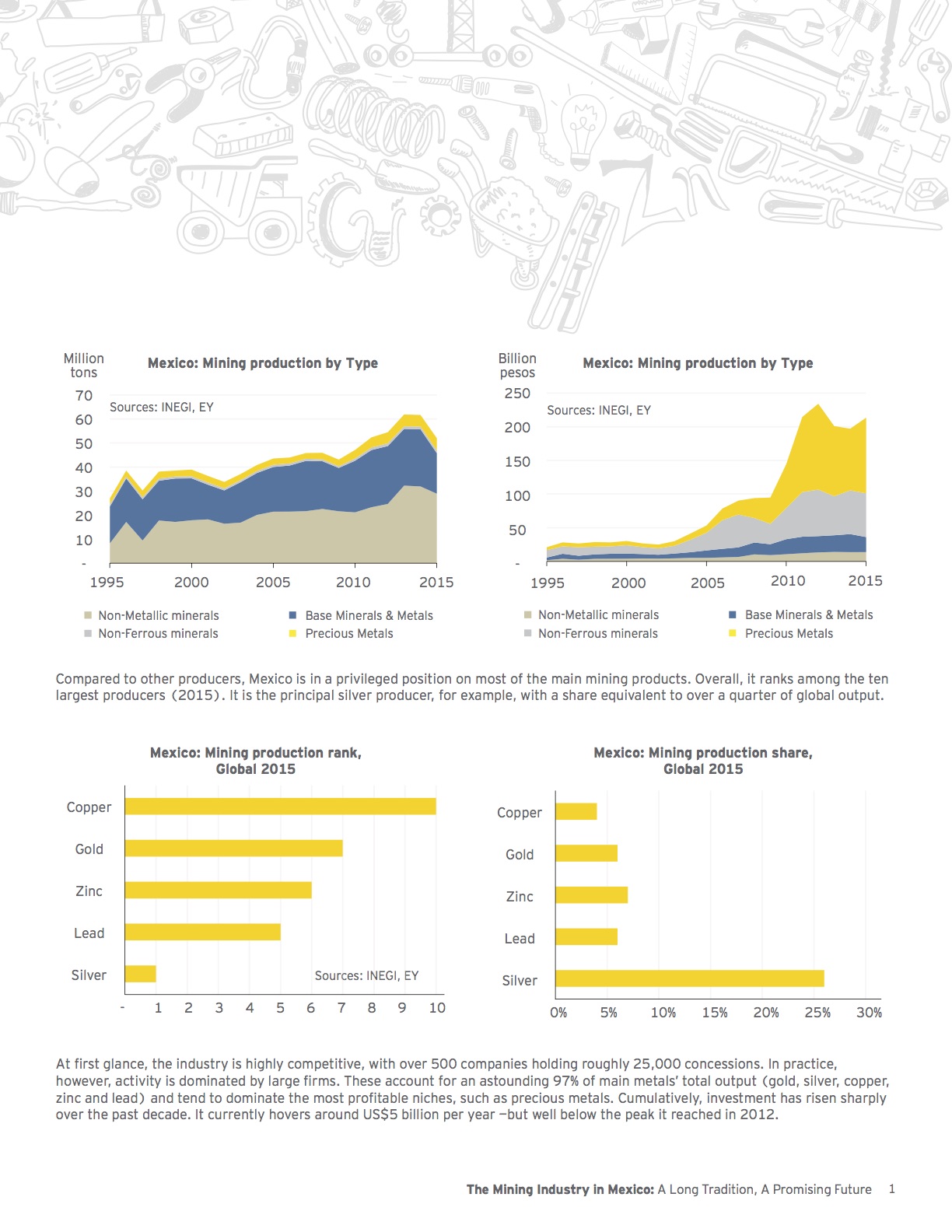

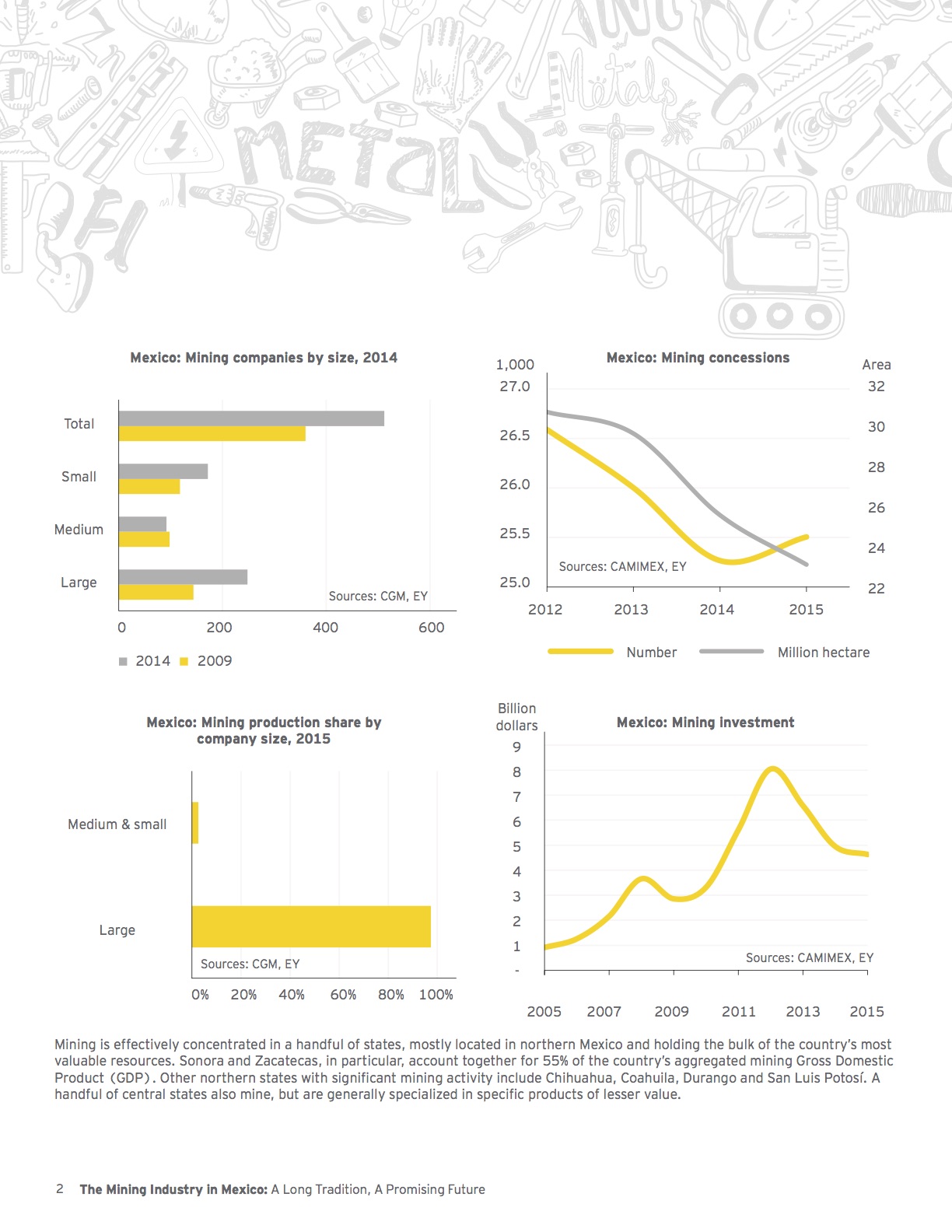

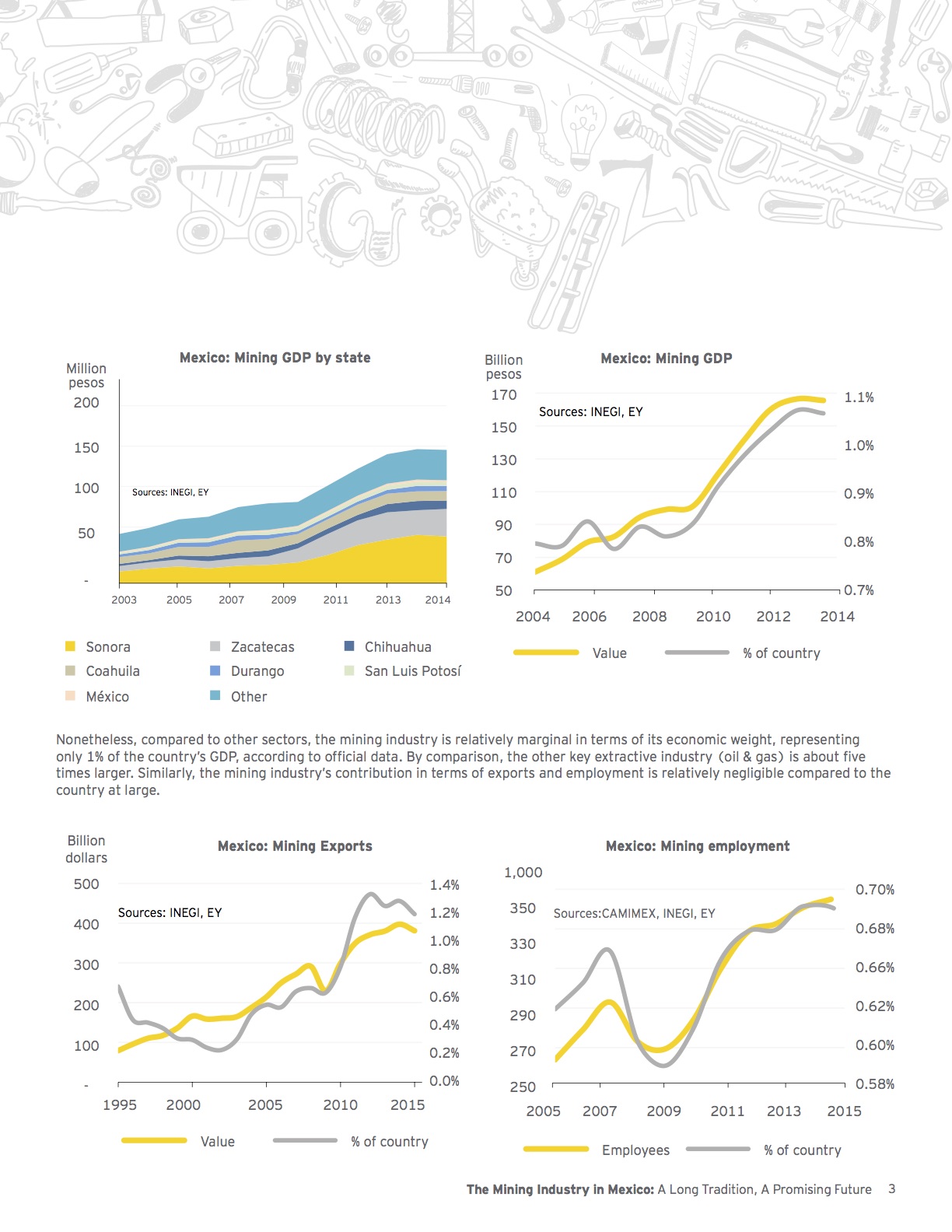

Mining In Mexico: An EY Report

Recently, EY published a brief report on the state of mining in Mexico.

We have distributed it here for your ease and if you have any questions or would like to discuss any of our Mexico activities,, please do not hesitate contact us.

Click here for the full report.

All credit and ownership belongs to Deloitte & Touche LLP and affiliated entities.

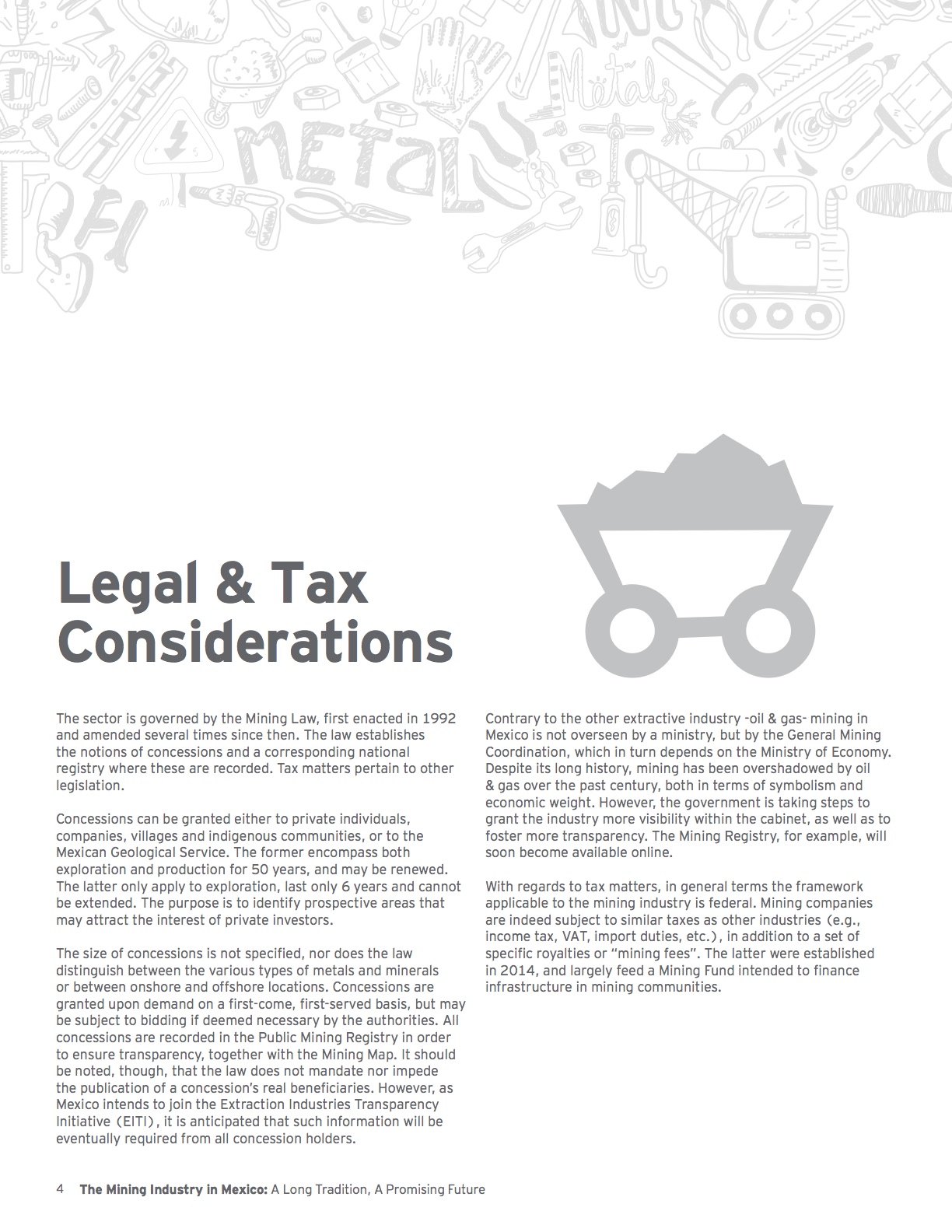

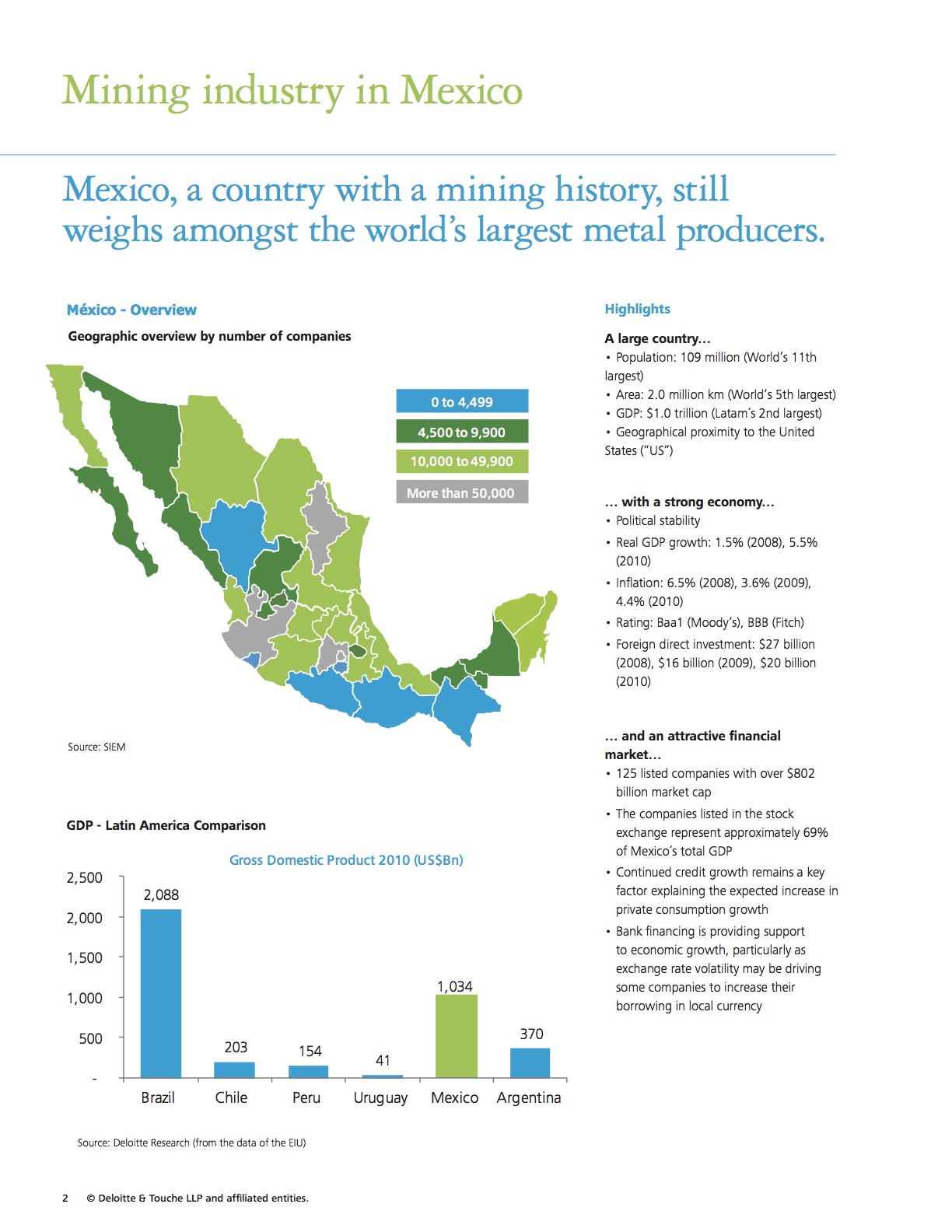

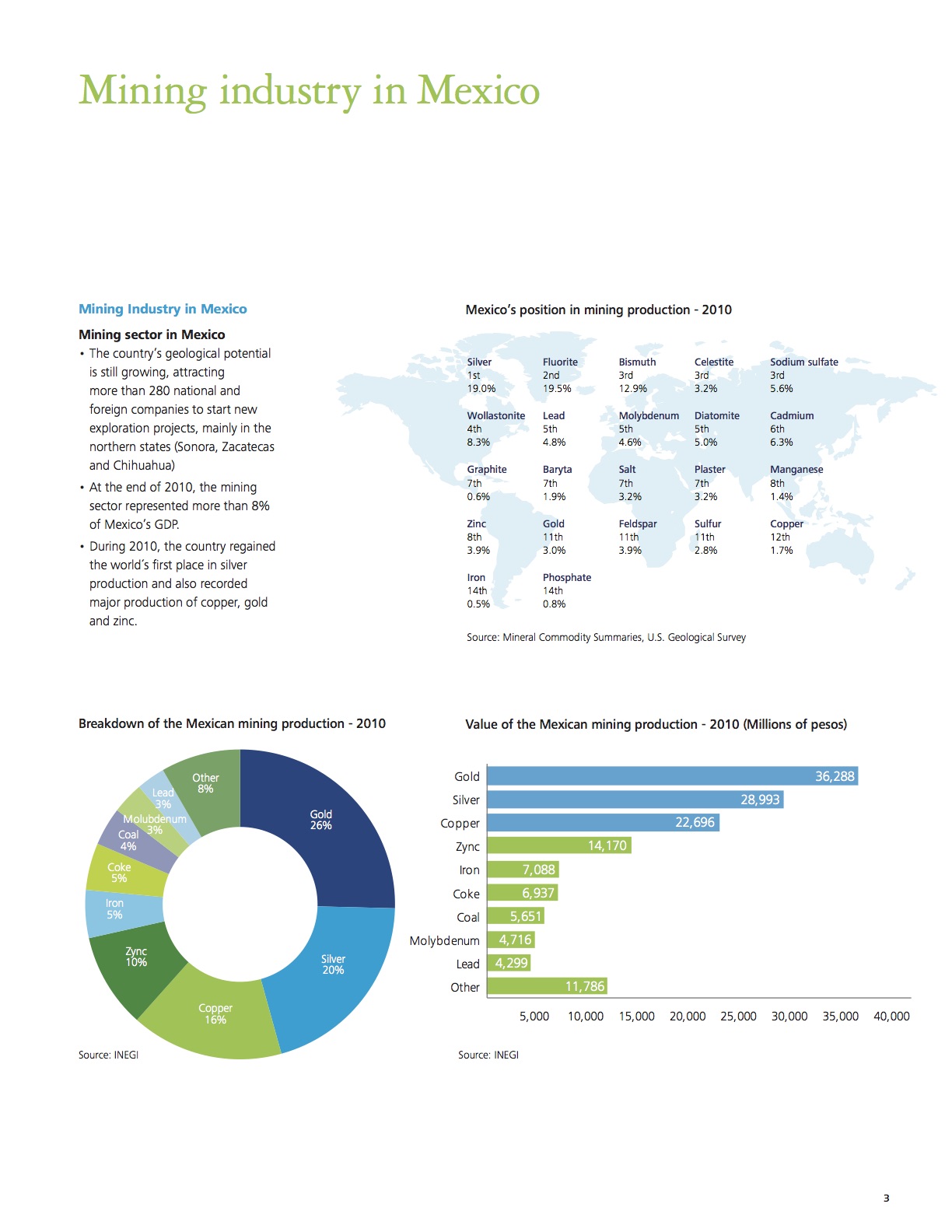

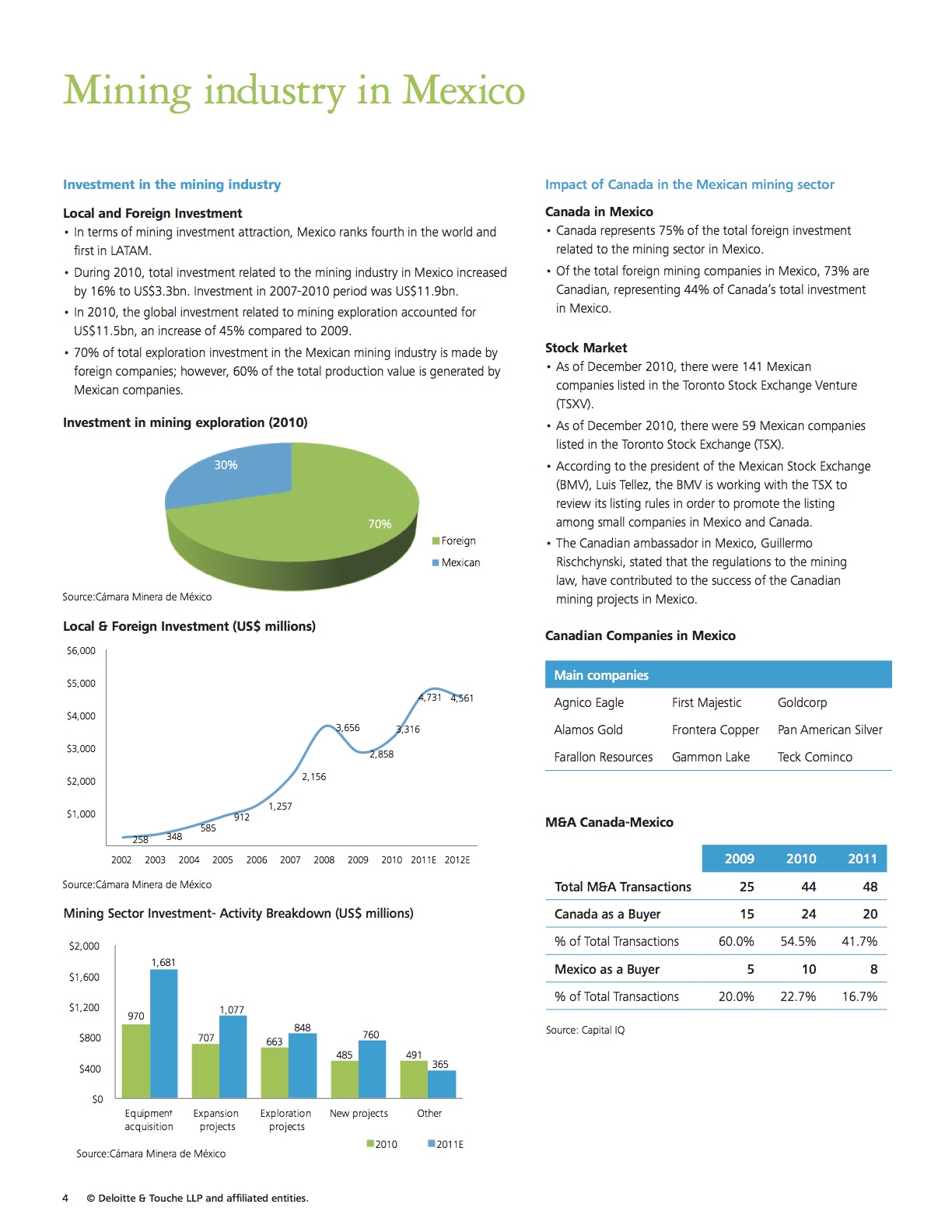

Mining In Mexico: A Deloitte Report

Recently, Deloitte published a brief report on the state of mining in Mexico.

We have distributed it here for your ease and if you have any questions or would like to discuss any of our Mexico activities,, please do not hesitate contact us.

Click here for the full report.

All credit and ownership belongs to Deloitte & Touche LLP and affiliated entities.

Visual Capitalist: Project Generators

Visual Capitalist: The Mineral Exploration Roadmap

CEO Interviews About Drill Results from La Navidad

It has been a busy start to the year for the team at Millrock and as we near the end of Q1, I wanted to send over some updates on the company!

Recently, CEO Greg Beischer linked up with Maurice Jackson of Proven and Probable and Gerardo Del Real of Resource Stock Digest to talk about recent company advancements including the release of our drill results from La Navidad in Mexico and our plans for drill programs in Mexico, Canada, and Alaska.

There is a lot of good information in both, so please take a listen.

Proven & Probable:

Limited Downside, Unlimited Upside

Resource Stock Digest:

Results from La Navidad, Mexico & Summer Drill Programs

It will be busy and exciting spring season and we look forward to providing you with updates as we keep the drills turning. With so much exploration drilling ongoing there is good potential to make a discovery that could propel Millrock’s share price upward.

If you have any questions or would like more information, do not hesitate to reach me at the numbers below.

Take care and enjoy the week.

Gregory Beischer Discusses The El Picacho Acquisition with Centerra Gold

20 Tips For Successful Investing in Mining Stocks

Considerable Profits Can Be Made By Investing In Mining Stocks—But You Need To Follow These 20 Tips

We think most investors should consider investing in mining stocks as part of a diversified portfolio.

Mining stocks are investments in companies that produce or explore for minerals, such as uranium, coal, molybdenum (which is used in steelmaking), copper, silver and gold.

Mining stocks can generally be broken up into two categories, majors and juniors. Majors are typically mining companies that have been in the mining business for many years and more often than not they operate producing mines on a global scale. Majors have proven methods for exploration and mining, and have consistent output year over year.

Junior mining stocks are usually smaller companies and take on risky mining exploration. If a junior mining stock is successful at finding a mineable mineral deposit, it can mean huge returns for investors.

While junior mining stocks may offer some speculative appeal, we continue to recommend that you cut your risk in the volatile resource sector by investing in mining stocks of well-established mining companies with high-quality reserves. However, resource stocks (and this includes oil and gas, of course) should make up only a limited portion of your portfolio—say less than 20% for a conservative investor or as 30% for an aggressive investor.

20 tips for investing in mining stocks

- Focus on stable political regions: We generally stay away from mining companies operating in insecure and politically unstable regions like the Congo and Venezuela, or in countries with little respect for property rights and the rule of law, like Russia or Mongolia. Mining is inherently a politically vulnerable business; you can’t move the mine to another country, and local citizens sometimes believe that a foreign mining company is robbing them of their birthright, even though they need the foreign company’s capital and expertise to get any value out of the ground.

- Invest in mining stocks as a hedge against inflation: Many investors buy mining stocks, including gold stocks, as a hedge against inflation, and some mining stocks pay dividends. But most mining stocks also offer an inflation hedge—they rise along with commodity prices and inflation.

- Aim for a dividend yield: Copper stocks generally have higher dividend yields than gold stocks because they have steadier demand and more stable prices. As well, they’re usually much cheaper than gold stocks in relation to their earnings and cash flow. That means they potentially have less room to fall if markets in general fall. That’s also another way of saying that they can be less risky than gold.

- Consider investing in mining ETFs—especially for gold and silver: Gold and silver could well regain their highs and move up even further over the longer term, although they will likely remain volatile. Higher prices would arise from investor fears that inflation or global political and economic instability will hurt key currencies, such as the euro or the U.S. dollar. If you want to hold a number of gold or silver stocks, many exchange traded funds offer top-quality global miners and low fees.

- Look for longevity in reserves: When you invest in any resource stock, gold included, you need to look at how long the company’s reserves are likely to last. Those with low reserves need to have consistent success in their exploration programs to maximize the production of the mine and the surrounding area. That success is far from guaranteed.

- Invest in stocks with a broad base of operations: Even if the company has strong reserves, the best mining stocks with the least risk also have a diversified reserve base. That way they are not dependent on a single mine’s production or political stability in any one country. Mining companies can also increase their reserves by making acquisitions—with mineral prices down from their record highs, you may see an increase in mining company acquisitions at distressed prices.

- Look into steady production: Some of the most highly promoted mining stocks, including gold mining stocks, are penny stocks which have yet to produce an ounce of gold or other minerals. Many must still add to their reserves, invest in mine-feasibility studies, and raise a lot of money before they go into production. The prospects for most of these penny-mine properties, even though they may be in areas with production from existing mines nearby, are far from certain.

- Seek strong reserves, low production costs and mines that are already producing: Good mining stocks have a range of development projects, but their strong base of production cuts the risk of relying on new developments alone.

- Focus on established areas: When we recommend mining stocks, we prefer those that operate in an area with geology that is similar to that of nearby producing mines.

- Think like an environmentalist: We look at environmental constraints where juniors are looking for minerals. In Europe and certain parts of the U.S, they need a particularly rich find to justify the costs of overcoming environmentalists’ objections.

- Invest in well-financed mines: We look for well-financed mining stocks with no immediate need to sell shares at low prices, since that would dilute existing investors’ interests. The best junior miners have a major partner who has agreed to pay for the drilling or other exploration or development, in exchange for an interest in the property.

- Look for strong balance sheets: The best mining stocks all have strong balance sheets and low debt.

- Pick the right location: We want to see favourable factors, like strong mineral showings from extensive drill programs, before we recommend investing in mining stocks that operate in hostile environments, like the high Arctic.

- Avoid hype: We avoid investing in mining stocks that trade at unsustainably high prices due to broker hype or investor mania about the underlying commodity (such as gold). Instead, we focus on reasonably priced mining stocks with favourable geology.

- Look at the market cap: We always look at the market cap of gold mining stocks versus the estimated value of the mineral resource they have in the ground. Sometimes, a company’s marketing efforts are so successful that they drive the stock up too high in relation to the size of its ore body. For example, we like a gold stock’s market cap to be no more than half the value of the gold. We assume that the company will be able to expand its ore reserves after the mine opens, but if the mineral reserves are double the gold mining stock’s market cap, it provides a margin of safety.

- Seek high average daily trading volume: This is one positive factor to look for when picking junior mining stocks. The more actively traded junior mines are, the more liquid they are, which makes them easier to dispose of when it’s time to take profits.

- Avoid mining stocks that trade at unsustainably high prices: This is usually due to broker hype or investor mania about the underlying commodity (such as gold). Instead, we focus on reasonably priced mining stocks with favourable geology.

- Identify a partner: The best junior mines have a major partner who has agreed to pay for the drilling or other exploration or development, in exchange for an interest in the property.

- Think twice about gold bullion: Gold bullion investments have hidden costs that dramatically eat into your earnings potential over time. Gold bullion and gold coins require insurance and special storage plans which will incur costs for as long as you keep them.

- Invest in gold stocks instead of bullion: Invest in gold through gold-mining stocks. Unlike bullion, these stocks at least have the potential to generate income. High-quality gold stocks can pay off nicely by establishing new mines and raising their production, even if gold goes sideways for a lengthy period. But keep in mind that no matter how appealing they look, you should limit gold stocks to a modest part of your portfolio.

Although investing in mining stocks can be highly volatile, they often make good long-term investments. They may be well-known stars or quiet gems, but they do share one common attribute—they have grown at higher-than-average rates within the mining industry, or within the market as a whole, for years or decades.

Do you have a process when you’re investing in mining stocks that you’d like to share? What else would you add to this list? Share your experience with us in the comments.

A Beginner's Guide To Mining Stocks

If it isn't grown, it has to be mined. You've probably heard some variation of this saying. It is used by people concerned about the environmental effects of mineral depletion as well as people bullish on mining stocks. Although these two groups have a very different emphasis when they speak it, they are both right - mining is big business. Almost every commercial product has elements that started off buried beneath the earth. Here are a few things that you should know before adding mining stocks to your portfolio.

Two Stocks, One Sector

Mining stocks are truly two distinct groups: majors and juniors. The majors are well-capitalized companies with decades of history, world-spanning operations and a slow and steady cash flow. Major mining companies are no different from large oil companies, and many of the same metrics apply with a mining twist. Both have proven and probable reserves, except mining companies break down profit and cost on a given deposit by ton, instead of barrel. In short, a mining major is easy to evaluate and easy to invest in.

The junior mining stocks are very nearly the exact opposite of mining majors. They tend to have little capital, short histories and high hopes for huge returns in the future. For the juniors, there are really three fates. The most common is failure, which leaves a hole in everyone's pocket, including that of the banks and investors. The second fate occurs when a junior has enough success to justify a major paying a decent premium to gobble it up, leading to decent returns all around. In the third and most rare fate, a junior finds a large deposit of a mineral that the market wants a lot of; it is a magical combination of the right deposit at the right time. When this happens, juniors can return more in a few days than a major will return in years.

Valuing Major and Junior Mining Stocks

Although majors and juniors are very different, they are united by the one fact that makes all mining stocks unique: their business model is based on using up all the assets they have in the ground. The catch is that mining companies don't know exactly how much is in a given deposit until it is all dug up. Therefore, the value of mining stock roughly follows the market value of its reserves, with a premium paid to companies with a long history of successfully bringing those reserves to market.

Reserves are evaluated through feasibility studies. These studies independently verify the worth of a deposit. A feasibility study takes the estimated size and grade of the deposit and balances it against the costs and difficulties of extracting it all. If the deposit will fetch more money on the market than it costs to dig up, then it is feasible.

Different Risks, Different Rewards

If a mining major has hundreds of deposits staked and/or being mined, the contents of any single deposit aren't likely to shake the stock value too much. A major is the sum of all the deposits with the aforementioned goodwill tied to history. A change in the market value of a mineral that makes up a larger percentage of the deposits will have a much larger effect than a new deposit or a failed deposit. A junior mining stock lives or dies on the results of its feasibility studies.

A junior mining stock sees the most action leading up to, and immediately after, a feasibility study. If the study is positive, then the value of the company may shoot up. The opposite, of course, is also true. Often, a junior miner won't mine a feasible deposit to the end. Instead, they sell the deposit (or themselves) to a larger miner and move on to search for another one. In this sense, junior mining stocks form an exploration pipeline that feeds the major miners in the end. In this view, the big risks and rewards mostly reside at the junior mining level.

Choosing Between Majors and Juniors

As an aspiring mining investor, you're probably wondering whether you should invest in junior mining stocks or major mining stocks. The answer depends on what you are looking for. Juniors have the potential to offer a lot of appreciation in the right market. This makes them an ideal destination for risk capital, but hardly the best place to put your social security checks. If you are looking for a lower-risk stock with the potential for dividends and some decent appreciation, then major mining stocks may be for you.

The Bottom Line

This is a primer and as such, suffers from being overly broad and simplistic. Before you invest in the mining sector, you should probably know what greenfields exploration is, how to estimate the impact of pricing risk and be able to hold forth on the dangers of buying on a single positive assay. If you are keen enough on mining to do some research, then there is probably room in your portfolio for both mining majors and juniors.

Read more: A Beginner's Guide To Mining Stocks

Follow us: Investopedia on Facebook