VANCOUVER, BRITISH COLUMBIA, November 30, 2021 – Millrock Resources Inc. (TSX-V: MRO, OTCQB: MLRKF) ("Millrock" or the “Company”) is pleased to have received notice from Felix Gold that it has lodged a prospectus with the Australian Securities and Investments Commission. The filing initiates the process by which Felix Gold may become a publicly-traded company on the Australian Securities Exchange (“ASX”). If successful under the proposed schedule the company shares would begin trading in January 2022. Depending on the concurrent capital raise, Felix Gold would have between AUD$10 million and AUD$13 million in their treasury, with much of that funding to be directed to exploration of the mineral claims that have been contributed by Millrock and/or staked or acquired by Felix Gold in the Fairbanks Mining District. Upon successful IPO and capital raise, Millrock will be entitled to a payment of Felix Gold shares. It is anticipated that the ASX will impose a mandatory restriction on the disposal of these shares of up to two years. Readers are cautioned that the share payment will only be made if the IPO is successfully completed.

Millrock President and CEO Gregory Beischer commented: “This is great news for Millrock and its shareholders. Depending on the amount of money raised in the IPO, Millrock will receive Felix Gold shares with an initial value ranging between approximately US$1.7 million and US$1.9 million. Additionally, Millrock will be entitled to production royalties on all of the claims comprising the current extensive property position and on future claims that may be acquired within a large Area of Interest surrounding the Fairbanks Mining District. Millrock will be entitled to Advanced Minimum Royalty payments that begin January 2022. Some excellent targets have been developed over the past year, while Felix Gold was an unlisted company. With a strong treasury and a robust 2022 budget, Felix Gold will have a great chance to make new gold discoveries and expand the gold resource at the Grant Mine. Any exploration success should result in strong appreciation of the Felix Gold shares that Millrock will hold, and also should support Millrock’s share price.”

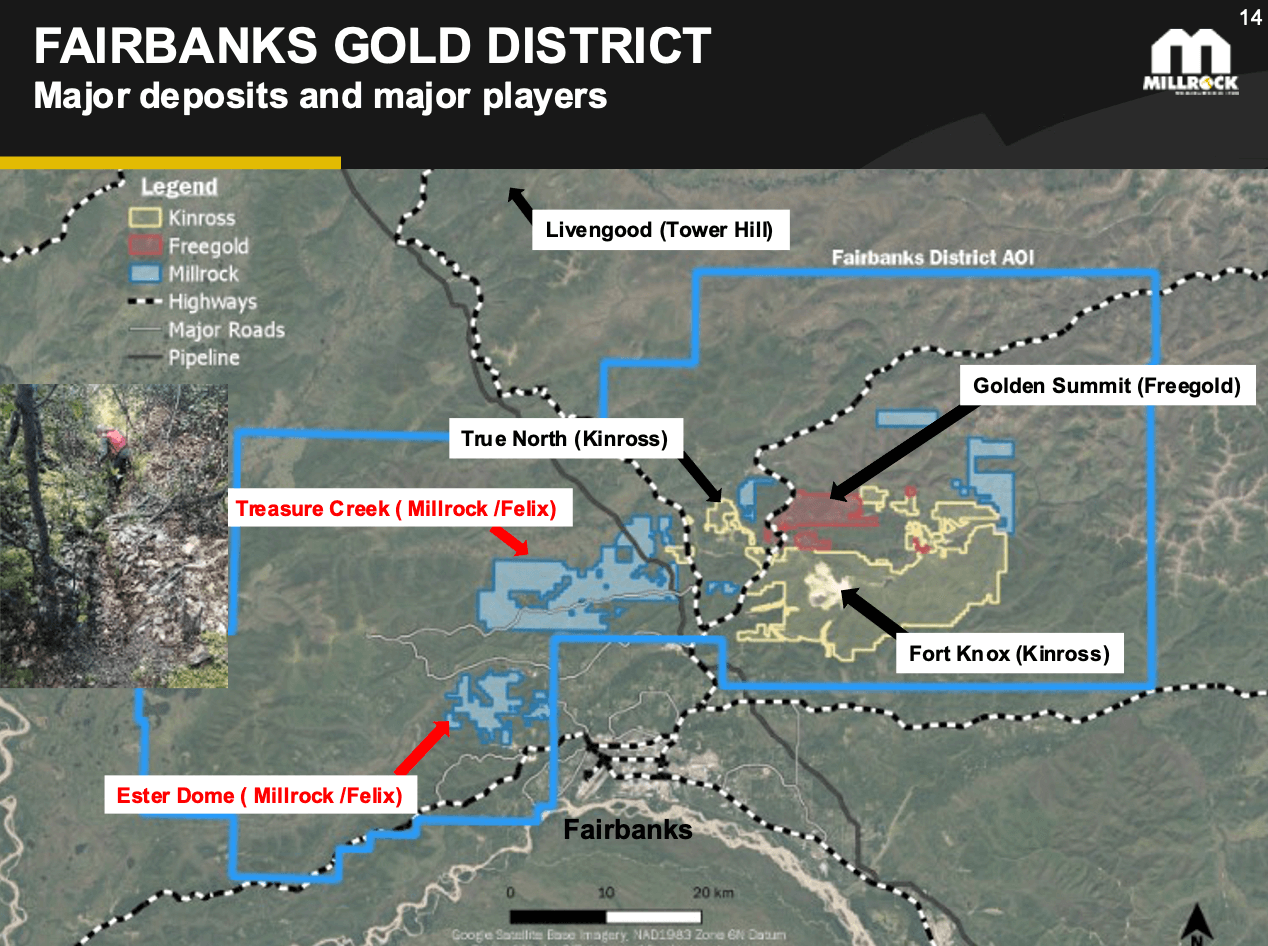

As reported in a January 12, 2021 press release, Millrock assigned Felix all of its rights in the Fairbanks area Ester Dome and Treasure Creek properties. It had held these rights for several years under agreements with prospectors. The Fairbanks Mining District is located within the prolific Tintina Gold Province, which spans Alaska and Yukon.

The Felix Gold prospectus indicates that (assuming the IPO and capital raise is successful) Millrock will be issued a minimum of 9,957,157 and a maximum of 11,442,384 Felix Gold shares at an IPO price of AUD$0.25 with an indicative initial value ranging between AUD$2,249,289 (CDN$2,047,389) and AUD$2,860,596 (CDN$2,603,491). The number of shares to be issued is dependent on the amount of capital raised. The shares will only be issued to Millrock if the IPO and capital raise is successfully completed.

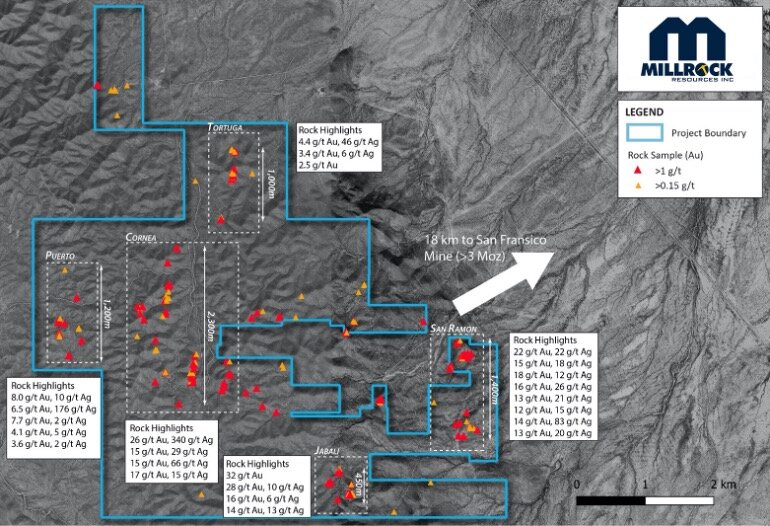

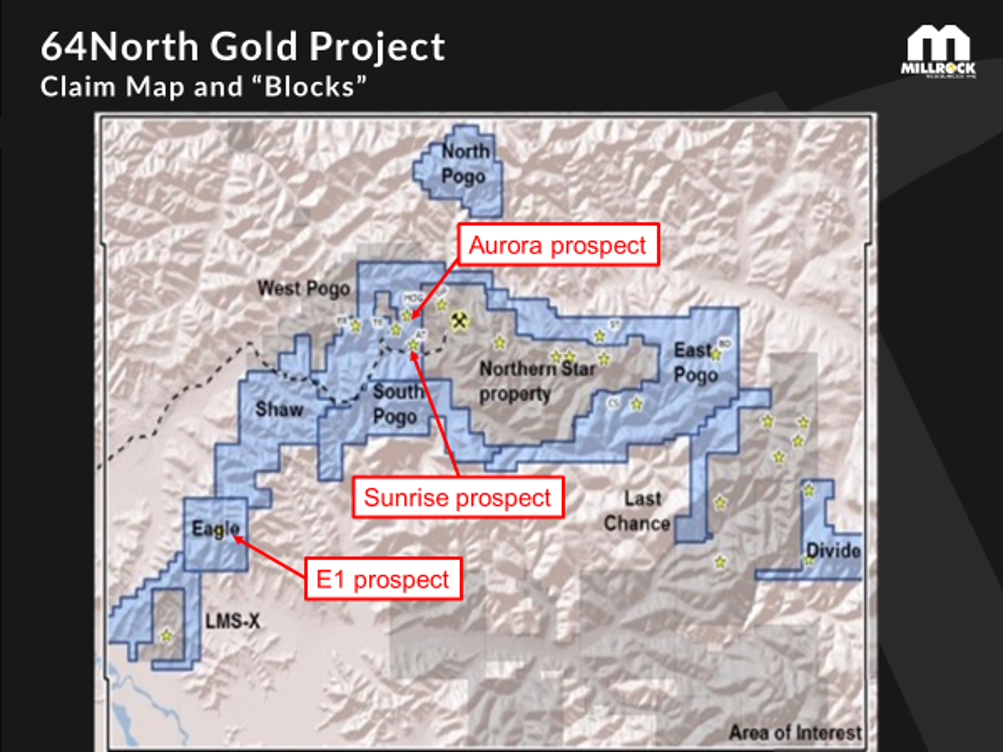

Since signing the initial agreements in January 2021, the Felix Gold team, working in collaboration with Millrock, significantly expanded the claim package, targeting areas that appeared to have high potential based on a systematic evaluation of public data and Millrock’s proprietary database. A large soil sampling effort was carried out in 2021. More than 3,000 soil samples were collected using power augers which allow for the collection of soil at the bedrock – overburden interface. Overlying overburden in the Fairbanks area often consists of very fine grained windblown sediments with or without permafrost making traditional soil geochemical surveys less effective. This work has served to identify strongly anomalous areas on the Treasure Creek project with three main prospects: NW Array, Scrafford, and Eastgate. The survey also identified strong anomalies at the Northeast Fairbanks portion of the project, which is proximal to Kinross’ Fort Knox gold mine, the satellite Gil deposit recently put into production by Kinross, and the Golden Summit / Cleary Hill deposit, which is being actively explored by Freegold Ventures Limited (TSXV: FVL) with strong success.

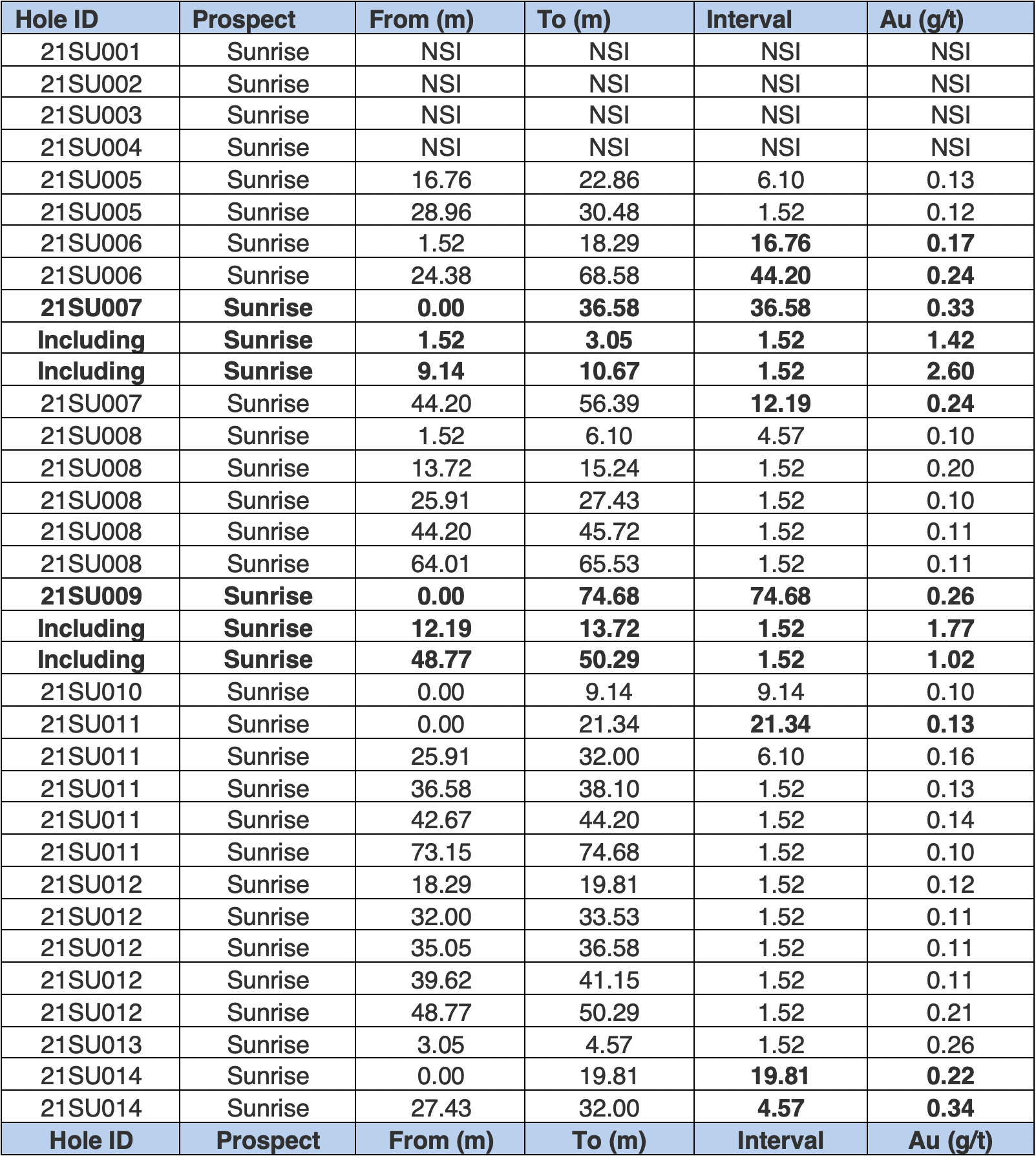

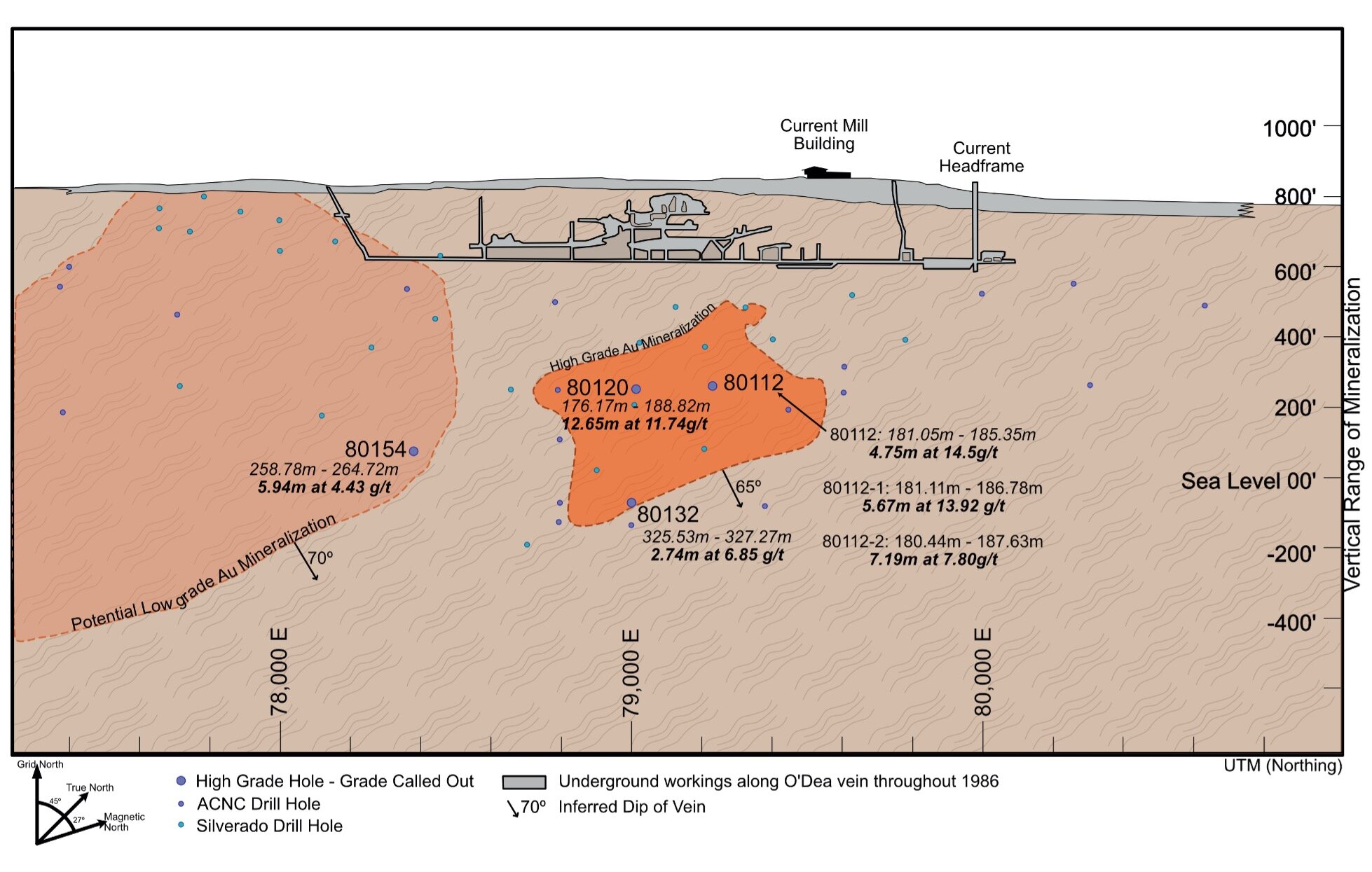

Felix Gold has examined data from the former-producing Grant Mine upon which they have an option to purchase a 100% interest. As a result of the data analysis, Felix Gold has been able to calculate a gold resource that is compliant with the Australia Joint Ore Reserves Committee (“JORC”) standards that govern such calculations in Australia (source: INDEPENDENT GEOLOGIST’S REPORTS ON FELIX GOLD LIMITED’S MINERAL EXPLORATION PROJECTS IN ALASKA, Prepared by Independent Geologist Mr. Ian Taylor of Mining Associates Pty Ltd., October 15, 2021).

The independent geologist’s report is appended to the Felix Gold prospectus and reports the following:

Inferred Mineral Resource estimate (JORC 2012) for Grant Mine of 5.8 million tonnes @ 1.95 grams per tonne gold for 364,000 ounces of contained gold including an underground resource of 136,000 ounces of gold grading 6.2 grams of gold per tonne.

And also: Grant Mine Exploration Target (JORC 2012) of 5.6 million tonnes to 6.6 million tonnes at a grade of 1.9 grams per tonne gold to 2.1 grams per tonne gold for 338,000 to 545,000 ounces of gold (exclusive of the Mineral Resource).

Note: The NI43-101 standards are the standards to which Millrock must adhere as a TSX Venture Exchange issuer, and the Australia JORC standards are those to which Felix Gold must comply as an Australian issuer. The JORC standards are robust, similar and parallel to the NI43-101 standards. JORC (2012) is defined as an ‘acceptable foreign code’ under NI43-101 reporting standards and the definition and classification of Mineral Resources are essentially the same as the NI43-101 Canadian Institute of Mining Definition standards. The Millrock qualified person has not independently verified the drill hole data, drill core, and estimation methodology as reported by Felix.

Figure 1. Plan View Map showing the location of the project within the Tintina Gold Province.

Figure 2. Plan View Map of Felix Gold land holdings in relation to the City of Fairbanks, Kinross’ Fort Knox Mine and Gil satellite mine, and Freegold Ventures Golden Summit / Cleary Hill gold deposit.

Qualified Person

The scientific and technical information disclosed within this document has been prepared, reviewed, and approved by Gregory A. Beischer, President, CEO, and a director of Millrock Resources. Mr. Beischer is a qualified person as defined in NI 43-101.

About Millrock Resources Inc.

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, is a significant shareholder of junior explorer ArcWest Exploration Inc. and owns a large shareholding in Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, Felix Gold and Tocvan.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

Toll-Free: 877-217-8978 | Local: 604-638-3164

Twitter | Facebook | LinkedIn

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including without limitation the successful completion of an IPO and capital raise by Felix Gold and the intention to mount further exploration including drilling in 2022. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements.