VANCOUVER, BRITISH COLUMBIA, February 23, 2021 - Millrock Resources Inc. (TSX-V: MRO) ("Millrock" or the “Company") announces that it has entered into an underwriting agreement with Redplug Inc. (“REDPLUG”) pursuant to which REDPLUG has agreed to purchase, on a bought deal private placement basis, 18,000,000 units of the Company (“Units”) at a price of $0.085 per Unit (the “Offering Price”) for aggregate gross proceeds of $1,530,000 (the “Bought Deal”), of which REDPLUG has deposited $1,275,000 in trust with Millrock.

REDPLUG has also been granted an option, exercisable in whole or in part any time up to 48 hours prior to the closing date of the Bought Deal, to purchase for resale up to an additional 4,500,000 Units at the Offering Price, for aggregate gross proceeds to the Company of $382,500 in the event REDPLUG exercises this option in full.

The Company also intends to undertake, concurrently with the Bought Deal, a non-brokered private placement of up to 6,000,000 Units for additional aggregate gross proceeds of $510,000 on the same terms as the Bought Deal (the “Concurrent Non-Brokered Placement”). There is no minimum offering size for the Concurrent Non-Brokered Placement but the minimum subscription amount is 60,000 Units ($5,100).

Each Unit will consist of one common share of the Company and one common share purchase warrant (the “Unit Warrants”). Each Unit Warrant will entitle the holder to purchase one additional common share of the Company at a price of $0.1275 per share for two years from the date of issuance.

It is the intention of the Company to provide an opportunity to existing, eligible Millrock shareholders to participate in the Concurrent Non-Brokered Placement. Non-accredited investors will be welcome to participate through use of the existing shareholder exemption provided in British Columbia Instrument 45-534 and similar exemptions in other jurisdictions of Canada to the extent available (the “Existing Shareholder Exemption”). This exemption is not available to a shareholder who is a U.S. Person (as defined in Regulation S promulgated under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”)). This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the Units or underlying securities (collectively, the “Offered Securities”) in any state in which such offer, solicitation or sale would be unlawful. The Offered Securities have not been registered under the U.S. Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

The gross proceeds from the Bought Deal and (if fully subscribed) the Concurrent Non-Brokered Placement in the aggregate amount of $2,040,000 will be used to advance exploration on the Company’s current projects (as to approximately $250,000), for generation of new projects (as to approximately $650,000), marketing of projects to funding partners (as to approximately $150,000) and the remainder for general corporate purposes.

If the Concurrent Non-Brokered Placement is oversubscribed and not increased (which would require the approval of the Company, REDPLUG and the TSX Venture Exchange), Units will first be allocated to EMX Royalty Corp. (which holds the right to maintain their current ownership percentage of Millrock shares) and thereafter pro rata among all subscribers in the Concurrent Non-Brokered Placement based upon the subscription amounts set out in their subscription agreements.

REDPLUG will be paid an 8% cash commission and will be issued broker warrants for the purchase, at the Offering Price, of such number of Units as is equal to 8% of the aggregate number of Units sold under the Bought Deal and Over-Allotment Option. Finder’s fees of 7% cash and 7% finder’s warrants (the “Finder’s Warrants”) may be paid in connection with the Concurrent Non-Brokered Placement. The Finder’s Warrants have the same terms as the Unit Warrants except that they will be non-transferable.

The Bought Deal and the Concurrent Non-Brokered Placement are subject to TSX Venture Exchange approval. All securities issued will be subject to a four-month hold period. The Bought Deal and the Concurrent Non-Brokered Placement are expected to close on March 8, 2022.

Existing Shareholder Exemption

To be eligible to subscribe under the Existing Shareholder Exemption, the subscriber must: a) have been a shareholder of the Company at the close of business on February 23, 2021 and continue to hold common shares of the Company until the closing date of the Concurrent Non-Brokered Placement, b) be purchasing the Units as principal for their own account and not for any other party, and c) not have subscribed for more than $15,000 of securities of the Company, including the current subscription, in the past 12 months unless they have first received advice from a registered investment dealer regarding the suitability of the investment.

Any existing shareholder or other interested investor who wishes to participate in the Concurrent Non-Brokered Placement should contact Janice Davies, Corporate Secretary of the Company, by email at: janice@jdconsulting.ca to receive subscription documentation and instructions. The deadline for existing shareholders to send their subscription agreement and funds to the Company is 4 p.m. PST on March 1, 2021.

About REDPLUG Inc.

REDPLUG Inc. is a registered exempt market dealer specializing in private placements in the junior resource sector, with a primary focus on silver, gold, platinum, and palladium. REDPLUG’s accredited investor clients are building positions in well-managed, insider-owned, resource companies including: prospect generators, advanced explorers, resource developers, and near-term producers. Visit REDPLUG.com or call 1-844-RED-PLUG.

About Millrock Resources Inc.

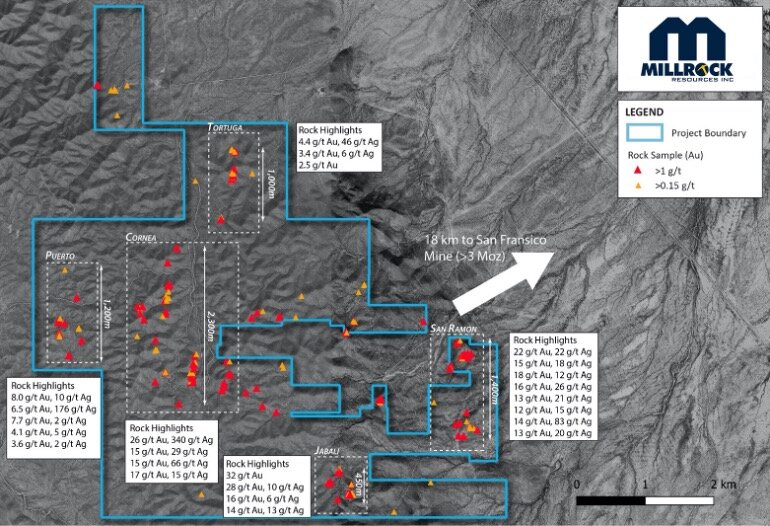

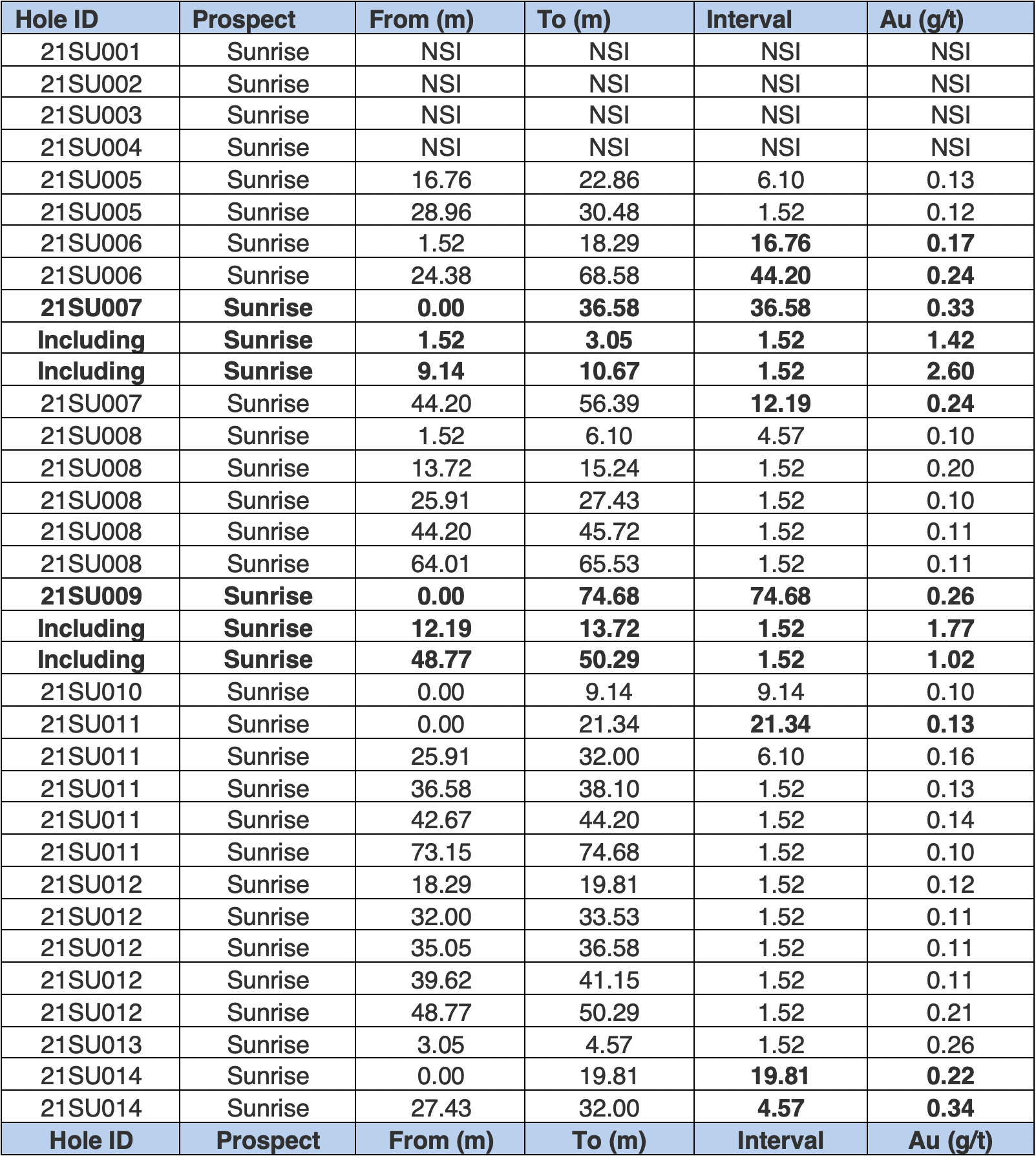

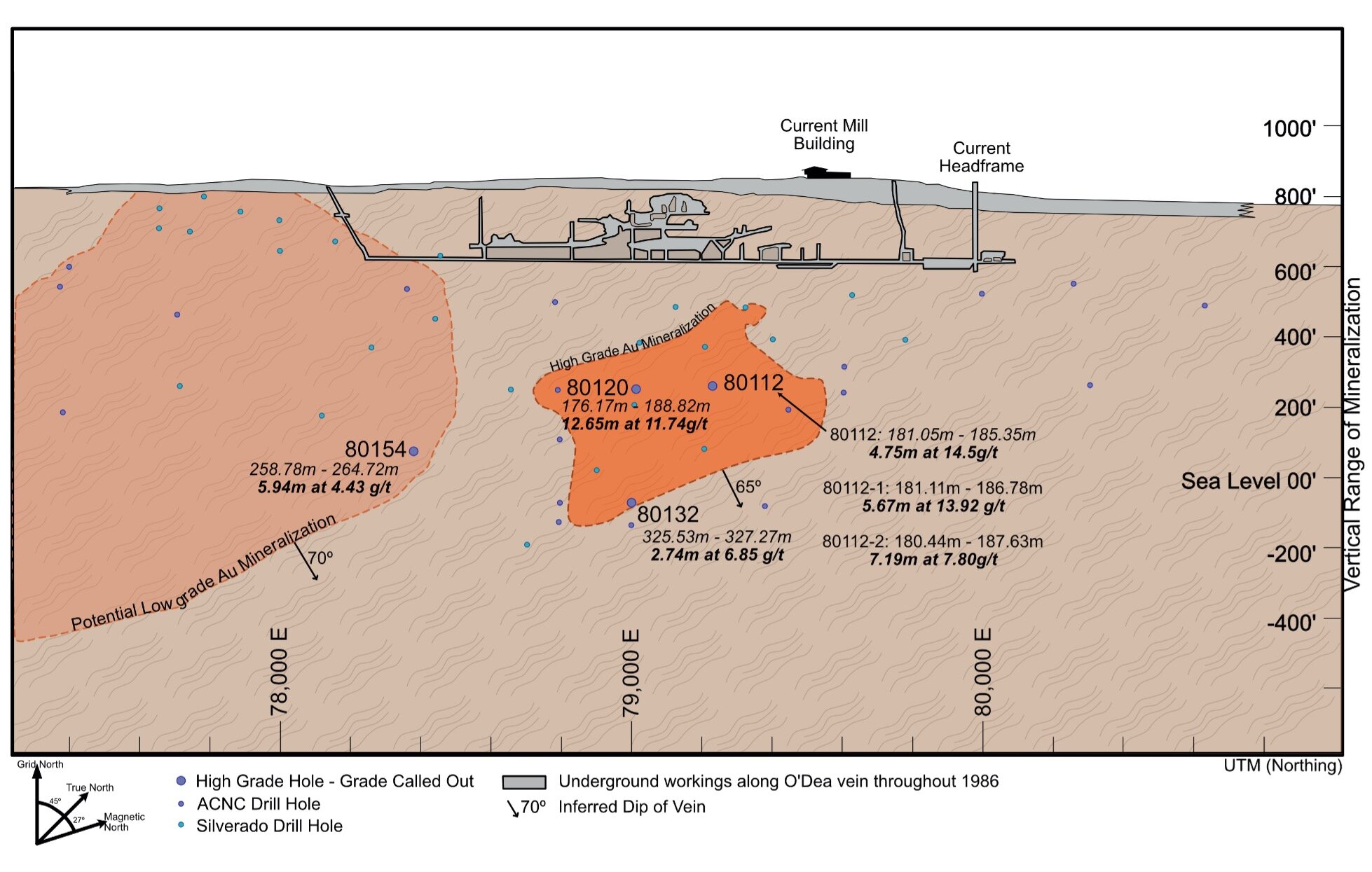

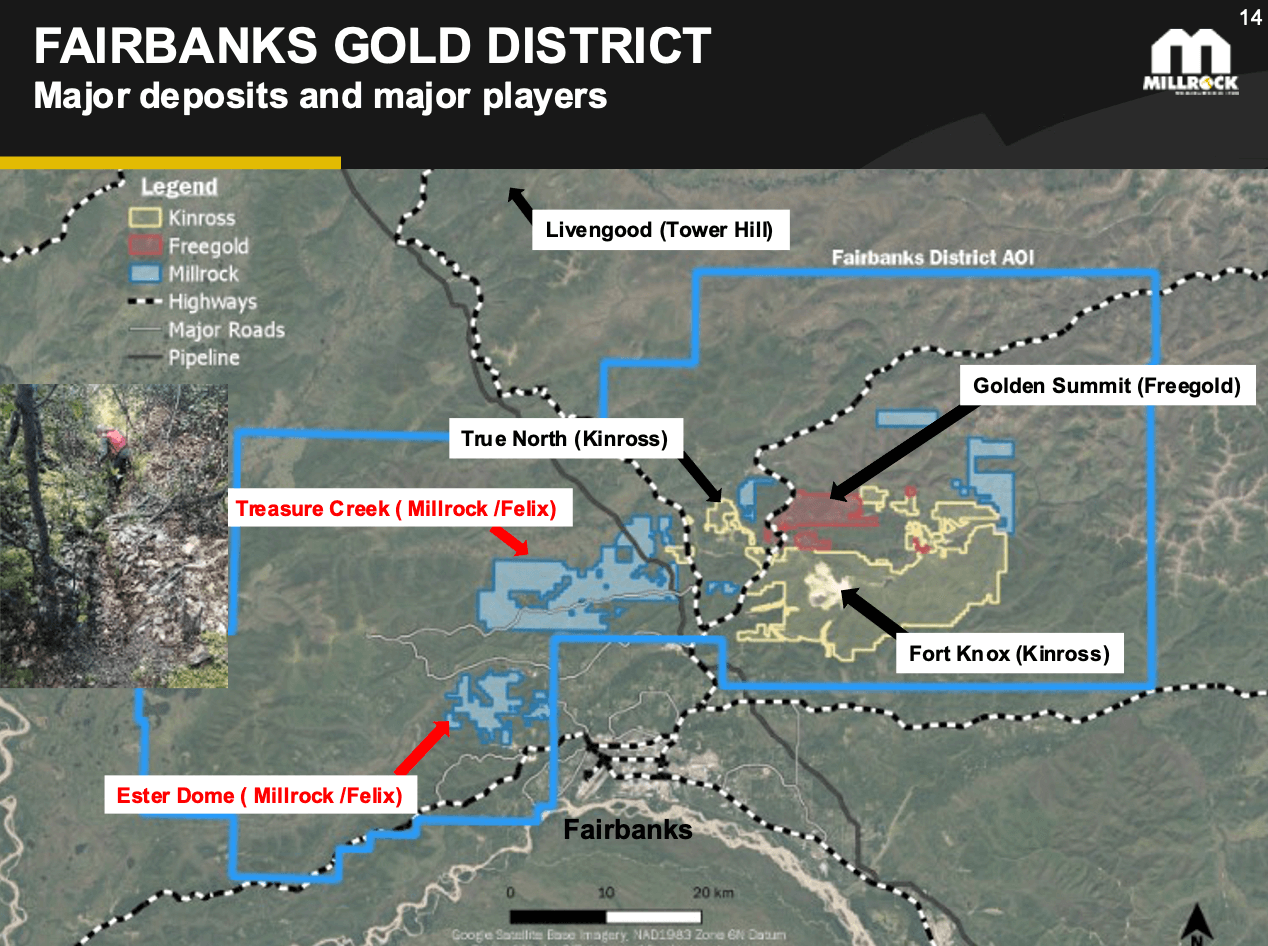

Millrock Resources Inc. is a premier project generator to the mining industry. Millrock identifies, packages, and operates large-scale projects for joint venture, thereby exposing its shareholders to the benefits of mineral discovery without the usual financial risk taken on by most exploration companies. The company is recognized as the premier generative explorer in Alaska, holds royalty interests in British Columbia, Canada, and Sonora State, Mexico, and is a significant shareholder of junior explorer ArcWest Exploration Inc. and of Resolution Minerals Limited. Funding for drilling at Millrock’s exploration projects is primarily provided by its joint venture partners. Business partners of Millrock have included some of the leading names in the mining industry: EMX Royalty, Centerra Gold, First Quantum, Teck, Kinross, Vale, Inmet and, Altius as well as junior explorers Resolution, Riverside, PolarX, and Felix Gold.

ON BEHALF OF THE BOARD

“Gregory Beischer”

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Melanee Henderson, Investor Relations

(604) 638-3164

(877) 217-8978 (toll-free)

This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of Offered Securities in any state in which such offer, solicitation or sale would be unlawful. The Offered Securities have not been registered under the U.S. Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation) including, without limitation, the intention to undertake the Bought Deal and the Concurrent Non-Brokered Placement and the intended use of proceeds. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, the receipt of TSX Venture Exchange acceptance, and completion of the Bought Deal and Concurrent Non-Brokered Placement.